Our casual conversations with convenience store operators indicate some tremendous changes taking place in the industry. They reported that fuel sales (and customers) are down 50% or more yet higher margins have been offsetting. The in-store sales driven by fuel customers must be down accordingly. Yet most in-store sales seem to be down only 20% and in some stores in-store sales are actually up. Certain products, such as self-serve hot foods and soft drinks, were shut down by law in some locales, so this cut off another group of customers. And while most stores sold out of the expected items, such as disinfectants, hand sanitizer, wipes, toilet paper, etc., they also experienced a whole range of stock outages on unusual items.

Clearly convenience stores are getting a lot of new customers who are balancing out the big reduction in traditional fuel customers. We decided to use our Convenience Store analytics to make sense of all these changes. Our first conclusion was:

Conclusion #1: Convenience stores have a new customer type: the Grocery Buyer or GB

Literally overnight, convenience stores everywhere have gained an important new group of customers due to the coronavirus pandemic. We refer to such a customer as a “Grocery Buyer” or GB. GBs are now visiting your store to purchase items that they used to buy at a grocery store. GBs are apparently choosing to shop at convenience stores because they are less crowded, more convenient and appear to reduce the potential exposure to Covid19.

We used our Front Office Platform to analyze data we classified into four buckets: urban, highway, residential, and rural. We then focused on several NACS subcategories of traditional grocery purchases. Taiga’s Convenience Store analytics provided by our Front Office Platform immediately began to provide useful insights:

- From the 30,000 foot view, we saw a clear upward trend in the sale of “grocery items” from month to month. This trend was so apparent, we decided to dig deeper and determine exactly what’s driving it.

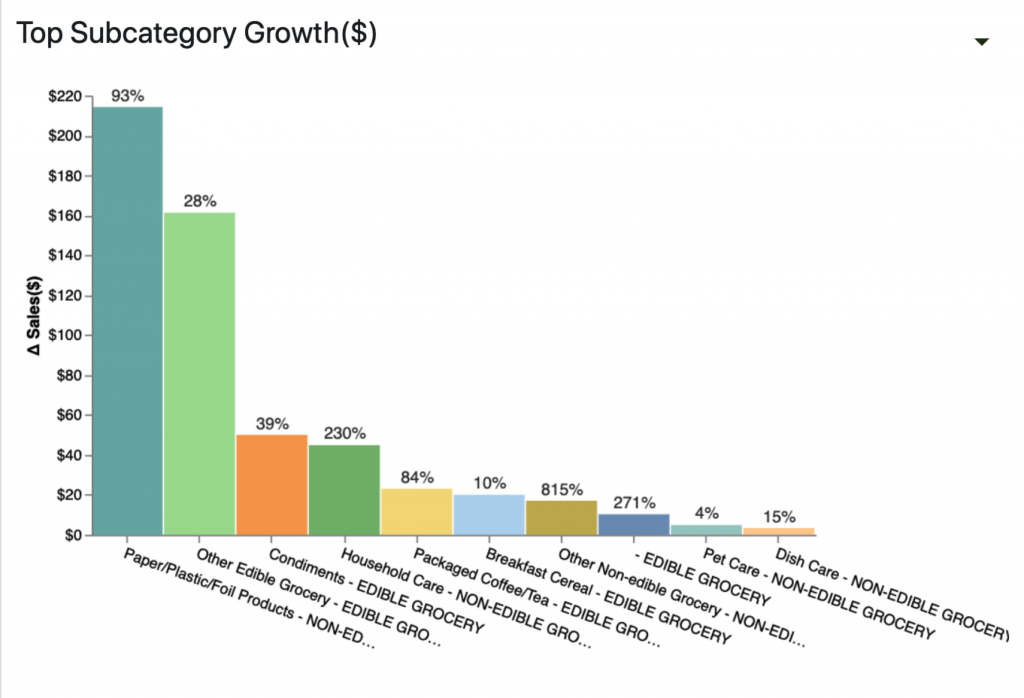

- When we took a closer look at the NACS categories of edible and non-edible grocery items, by revenue or volume, both approaches gave us the same result: increased sales of grocery items and paper products were making the biggest impact. We also determined that the following subcategories were also key contributors: Condiments, Pet Care, and Cereal. Click on the image below to see the full-size version.

Quick Tip:

Even though self-serve roller dogs were discontinued at some locations because of regulations, customers are purchasing their condiments at convenience stores. Given this, there is a sales opportunity if you have prepackaged hotdogs and buns available.

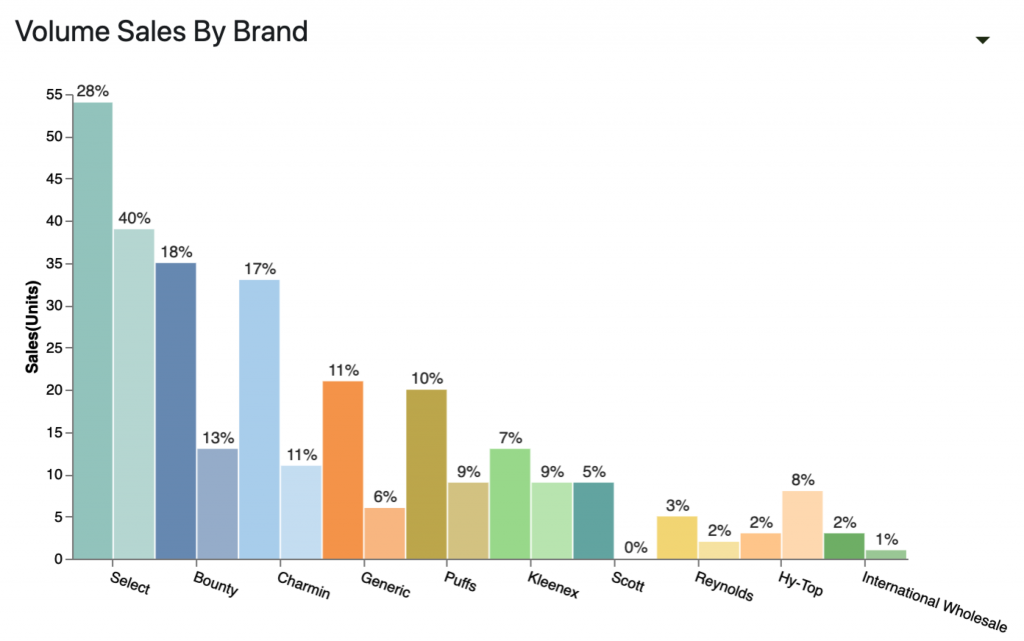

- Focusing on paper products; it is clear that local residents are now shopping at convenience stores for necessities including; paper towels, toilet paper and kleenex. This spurs the question: what else could be stocked that these customers might buy? Are there other related items like personal care or household cleaning products these customers would buy if they were available and prominently placed with these items?

- A more thorough market basket analysis of these trends would probably identify some additional new kinds of buyers and produce numerous opportunities to cross sell, improve margins and maintain loyalty among these customer types. Click on the image below to see the full size version.

- When we focused on the edible grocery category, we were surprised to see that the leading product was Ramen Noodles. A number of canned and packaged prepared foods and soups – things that used to sell like snails followed closely behind. This trend was most prevalent on weekdays at urban and suburban stores. Are there other related items like microwave meals these customers would buy if they were placed in proximity to these items?

Conclusion #2: Grocery Buyers can be converted to permanent customers

The pandemic is already starting to lift. Fuel sales are drifting upward. How long will you be able to retain the GB’s?

What can you do to make them permanent?

- The fear of exposure to the virus won’t be going away soon, so you want to make your convenience store an oasis of safety compared to the traditional grocery store.

- Make sure employees wear masks and do all the right cleaning (they will want to do it right for their own sake)

- But you need to do this work in a visible way, to give the GBs assurance you are clean. Have signs where staff indicate when they last cleaned the bathrooms or the door handles, etc. Have a guy offer to spray the handles of the shopping basket. Make the GB aware that you have the virus under control in your store. Don’t just be clean, give the impression of being clean.

- Have in stock what they want to add to the basket. Don’t disappoint them. Track down all your unusual outages and treat them as opportunities. If the GB discovers, that you have a lot of what they need, they will keep coming back because you are convenient.

- GB’s won’t come back if you overprice their products. Many of these new high volume items used to sit on the shelves. Now you need to shave your margins or you will drive the GBs back to the big grocery stores.

Situations like the pandemic are once in a lifetime occurances. But what if you could get Convenience Store Analytics at your fingertips whenever something unusual occurred? This is now possible with Taiga’s Front Office Platform. Contact us to learn more.