At 8:15am I walked into the conference room where I was teaching the staff of this Convenience Store chain how to use Taiga’s Front Office Platform and get started with Business Intelligence. The prior week we plugged in our Data Docks at each of their 17 stores. We immediately collected data from the local stores. Now we needed a day to set up personalized consoles to deliver each staff member the business intelligence they needed.

I often go on site to deliver staff education to the Convenience Store chains when we launch our Front Office Platform. You might expect, as CEO of Taiga, I would assign education to other people. But I find the first introduction of our business intelligence product to new Convenience Store clients to be very exciting, revealing unexpected new problems we can help solve. Besides, I really enjoy watching seasoned professionals change from bored skepticism to enthusiastic exploration. This installation would prove to be a good example.

I had the big screen running and had begun introducing everyone in the room. Then Joe, the Director of Operations, came in. It was obvious by the way everyone deferred to him that he was a key decision maker. I suspected he would probably benefit the most from Taiga’s Front Office Platform. It was also clear that this was not his “first rodeo” with business intelligence systems for his convenience store chain – his expectations were low. He kept looking at his phone, fidgeting. He even stepped out and made a call before I started.

When he came back I asked him what he was hoping to get out of the meeting. He ruefully smiled and replied:

“Well, I was hoping to actually get out of the meeting altogether, because I have a lot of things to do. I’ve been in the industry for 26 years, and seen the introduction of one new technology after another. But they’re always built for big companies with big IT staff. All they do is add more complexity than smaller operations like ours can handle, and then they fail when they discover the mess of our data. If you want to manage a Convenience Store chain of our size, nothing beats going out in the field to find out what is going on.”

The rest of the staff turned to look at me – would I fold like the last guy? This was going to be fun.

A Small Chain Had its Doubts

I asked him what he meant by “the mess of the data.” He smiled, nodding his head, as if this was an enjoyable part of “vendor education” he had often delivered.

“Well, first of all, every store we have has a different configuration. We can’t afford to force every store to use a certain setup because we buy and sell stores all the time. The POS systems are different. If two stores do have the same system, they are probably at different versions so they are still incompatible. You should go out to one of our stores and look at the equipment. It will be covered in dust because as long as it’s not broken, we leave it alone. The people who installed it are long gone. In most cases, we have the same system that was in place when we bought the store. We aren’t big enough to force our suppliers to use one category standard, so they all use their own and the data is all incompatible. Our Coke supplier knows more about our inventory than we do. Some of our equipment, like our ATGs, are so old, we have to print the numbers to get any data. How can anyone analyze missing or incompatible data?”

He wasn’t smoking a cigar, but if he had been, he would have been rolling it around now as he put me in my place. He’d been there, done this, and doubted our convenience store business intelligence system would deliver real results.

Fuel Price Challenges

I knew I had to get his attention before he left. So I picked a typical problem for most small Convenience Store chains. I asked: “How do you manage fuel pricing?”

“Hey, fuel is by far our biggest volume item and the margins are small. If we don’t adjust our prices to match what is happening in our area or we will lose our margins and our store traffic. The first thing we have to do is track what the other guys are charging. The only thing you can get online are national or regional averages, and those aren’t good enough. We have to take into account that certain stores are near the Interstate, others near fancy malls and others serve hundreds of truckers. The only way to get useful numbers is by driving around to the key locations that are relevant to the store we are trying to price. This is a lot of driving for our 17 stores. So I have a Director of Fuel Operations, Charlie, and he has three guys in pickups who make the rounds. As the numbers come in, Charlie adjusts the prices for each store individually. He then emails the store managers to make the changes. It’s slow and painful, but part of good Convenience Store management. Show me some stores where fuel pricing isn’t monitored constantly and I’ll show you an unprofitable chain.”

He looked at me expectantly, waiting for me to show what computer magic would solve this tangled problem.

I asked him one more question. “Do your store managers always change the prices to what Charlie says in his emails?” Joe frowned and said:

“Funny you should ask that. Just yesterday we had a manager miss his email and then the shift changed. Our fuel was overpriced for the entire afternoon. We also have some stubborn managers who think they know more than Charlie and delay price changes. So we have to tell the guys in the pickups to check our own prices, too.”

Fuel Price Solutions

Seeing the Competition

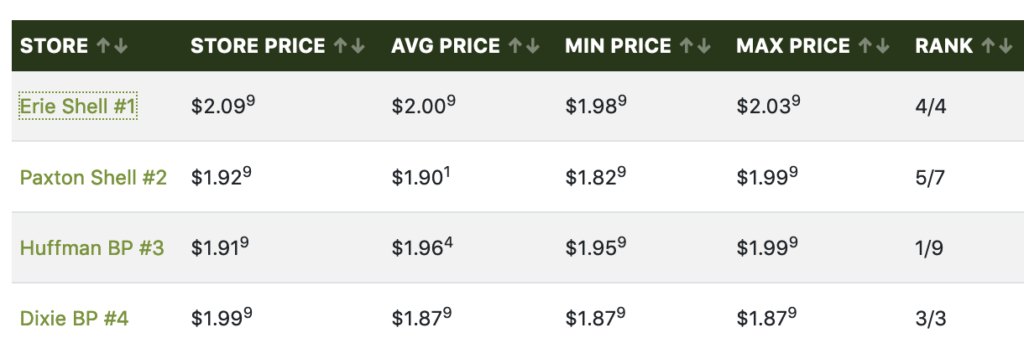

I stepped over to my laptop and said: “Let me show you how we can help Charlie decide prices for each store.” I displayed this chart:

“Your stores are in green on the left with their current price for regular.” Joe interrupted me, asking: “Current price as of when?” I said: “As of right now. If you call your Paxton Shell and tell them to change their price, we will see it change on this screen.”

Real Solutions

Joe said nothing. So I continued: “The average, minimum and maximum prices are from a group of 7 stations selected as the benchmark for Paxton Shell, and you can see that it ranks 5th highest out of the seven.” Joe asked: “You mean it isn’t regional averages? I can pick the benchmark stations to compare against for each of my stores? How can you get that data? How old is it?” I could see some of the skepticism fading, and went on: “We get our competitors’ pricing from a national service that is generally about a half hour out of date. Your stores pricing pulls from the pumps in real-time and reflects here immediately.”

Joe squinted at me and said: “What a minute. Are these really our stores or is this all fake news? You just started this project last week. How did you get all this data?”

I could see from his eyes that he really thought this whole display was a hoax. I answered Joe carefully. “Look, I know the data sources at these stores are a mess, and you’ve probably been frustrated with other computer guys who got overwhelmed by all the differences and old interfaces. But our company was founded by guys who spent over 20 years building interfaces like this. We built so many we decided to create a platform to collect the data based on our experience. So we don’t have to custom build the interfaces at each store. Now all we do to install a store is send the manager a little box we call a “Dock”. The manager plugs the Data Dock into the local network, and immediately we are live at headquarters. We don’t` even have to show up at the local stores, at least most of the time.”

Setting Fuel Prices

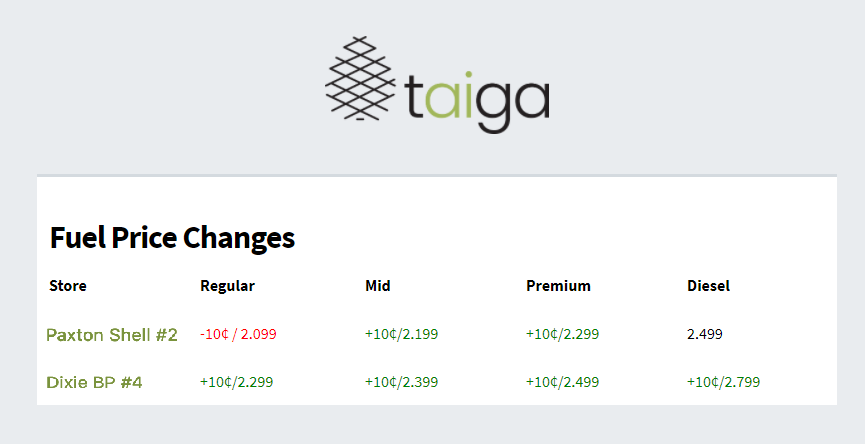

It looked like Joe would give me the benefit of a doubt. So I went on: “Let me show you another screen, because I haven’t told you the best part.”

“Once Charlie, at headquarters (or on his phone), looks at the live data and decides on a new price for the Paxton store, he just types it in and that price is live. You won’t be burning the tires off those pickups.” Joe said nothing. His eyes kept darting about as he did little calculations about cost savings and improved margins.

Wet Stock Inventory

Then I said “And Joe, we can give you ALL the data. Not just fuel prices, but product sales, inventory levels, who buys which things together, out of stock alerts – all of it. Let me give you one more example. How often do you change the filters on your pumps?”

Joe pulled his head back and gave me a puzzled expression: “We do routine maintenance every so often and replace them all.”

I nodded and said: “How would you like to get an alert at headquarters that pump four at Paxton had low flow and needed a new filter? These alerts would allow you to be real-time and replace as needed instead of all at once. Maintenance on demand instead of on a schedule.”

He nodded and then squinted again: “You must be getting data from our dispensers and those old ATGs. Can you tell me my wet stock at each store at headquarters without anyone checking?” I nodded. He said: “This changes everything!”. With just that statement I knew our Front Office Platform was going to deliver the business intelligence he needed for his Convenience Store Chain.