The coronavirus pandemic has created chaos and confusion across our industry. At Taiga, our mission is to bring order to chaos by identifying new trends and determine what is driving them through data analysis. We created the New Normal Newsletter to share some of the most common questions that we’ve received and the resulting analysis. This week are are looking at how the COVID lockdown impacted convenience store alcohol sales.

In Volume 2 we showed that while fuel sales and fuel customers are down by 50%, there is a new type of customer, the “Grocery Buyer”, filling the gap. To read more about the Grocery Buyers, click here to access Volume 2 of the New Normal Newsletter.

In this week’s edition, we focus on explaining the changes taking place within alcohol sales. Three different operators reported that alcohol sales were up but they were getting confusing signals from inventory counts and out of stock items. Why were some of their best selling products stacked high in the cold vault while they sold out of Craft Beer?

We began our analysis by feeding raw sales data into our Front Office Platform which confirmed that alcohol sales have increased substantially since the Lockdown, skyrocketing 14 – 26 percent. Next, we drill down into the categories, identify new trends, and the drivers behind them.

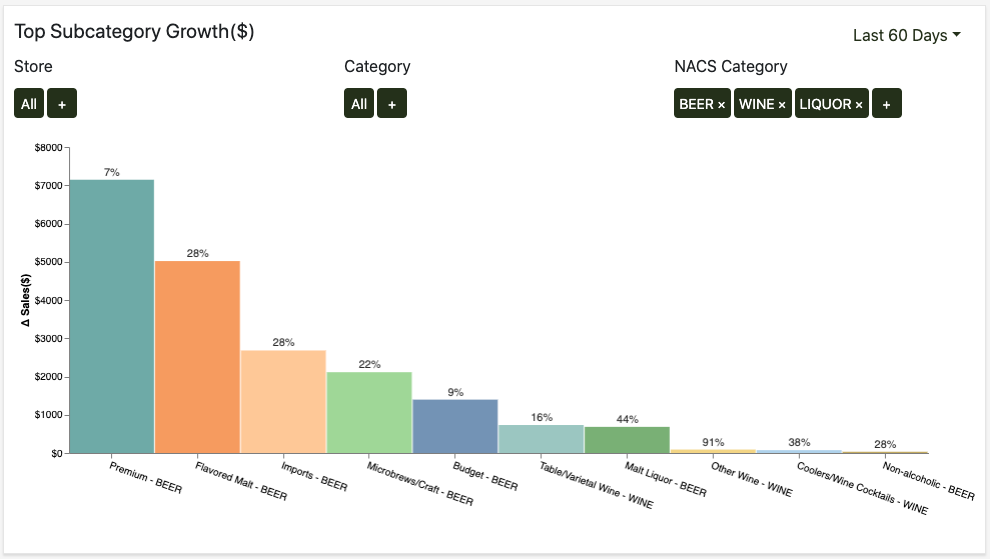

Observation 1: Alcohol sales are up, however the most explosive growth took place in unexpected subcategories.

We knew from last week’s Newsletter that the mix of customers has changed since the Lockdown and the addition of the Grocery Buyer has been disrupting the status quo. When your customer mix changes, so do the products found in the “market basket,” including alcoholic beverages.

While we need to keep in mind that there are seasonal variances that have nothing to do with the Lockdown, here are some of the sales trends that appear to have been caused by the change to the customer mix during March and April:

- Flavored Malt Beverage sales up 28%

- Craft Beer sales up 22%

- Imported Beer sales up 28%

- Premium Beer sales up 7%

- Liquor and wine were increasing rapidly as but starting from a very low volume

These trends explain why the inventory counts and outages were confusing: the new customers are increasing the sales of higher-end beverages like craft beer while traditional beer sales only grew by 7%. Convenience stores need to adjust their inventory to meet this new mix, or their shelves will be overstocked with some items and out of others. The fact that these rather significant changes were apparent in just a few days means c-store operators can’t afford to wait for end of month or end of quarter reports – they need to check their shelves now and adjust to the New Normal quickly.

Would you like to see what our Front Office Platform can tell you about your stores and customers?

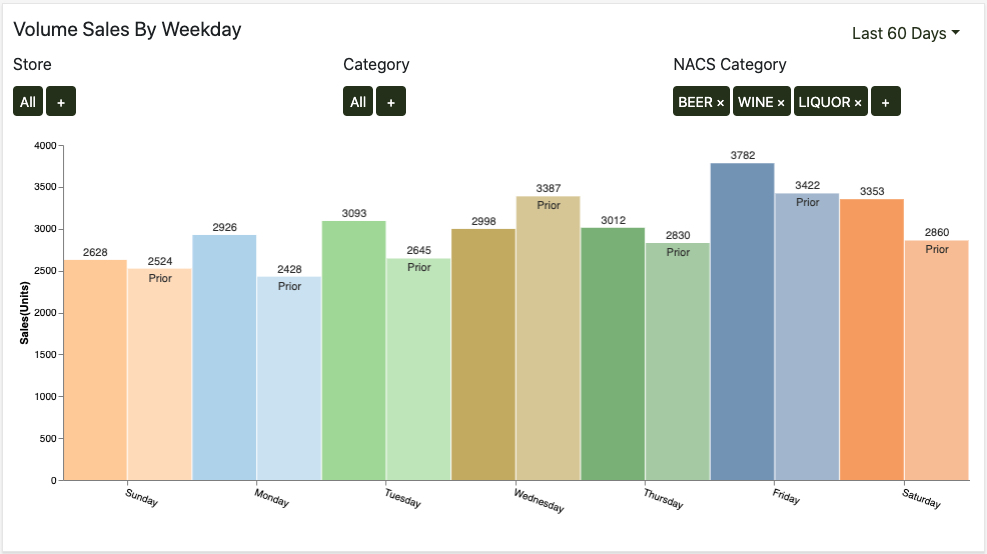

Observation 2: There have also been significant changes to alcohol buying patterns.

For example, in the past, alcohol sales peaked on both Friday and Saturday. They flatten Sunday – Monday and then moderate Tuesday – Thursday. New Normal alcohol sales levels still peak on Friday, are modest on Sunday, and up close to 20% on weekdays. It’s important to understand these new buying trends when you are running promotions or doing an in-store display.

Conclusion

The analysis of alcohol sales brings us back to the Grocery Buyers yet again. Last week we estimated that Grocery Buyers represent up to 25% of all in-store sales revenue. We also believe that they are responsible for most of the growth within the atypical subcategories like Craft Beer, and Wine. In an upcoming edition of the NNN we will do a full “market basket analysis” of the Grocery Buyer.

This change in Convenience store alcohol sales due to Covid provides operators the opportunity to take advantage of a nice increase in alcoholic beverage sales brought on by the Lockdown. They have captured a new type of customer, the Grocery Buyer. Operators can keep the Grocery Buyers for a long time but they will need to serve them by stocking shelves with the right product mix. This requires constant attention to the sales data on a weekly if not daily basis. Pay attention to your new customers and you will be able to keep them long after your fuel customers return.